DeKalb County Tax Office provides resources to understand property tax bills

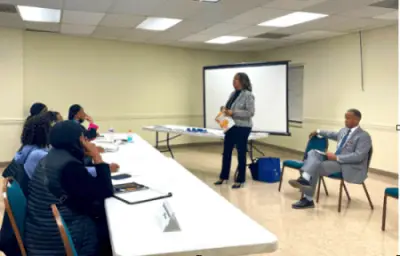

DeKalb County Tax Commissioner Irvin J Johnson and Chief Deputy Tax Commissioner Nicole M Golden standing discuss property taxes and homestead exemptions at a meeting at the Society Achievement Center Photo by DeKalb Tax Commissioner Representatives from the DeKalb County tax commissioner s office are available year-round to speak to population groups to help homeowners understand their tax bills according to a release from DeKalb County Tax bills are expected to be sent in August the release disclosed Since my office has conducted in-person and online public presentations to help homeowners understand their property tax bills and the importance of homestead exemptions DeKalb Tax Commissioner Irvin Johnson revealed We continue to offer presentations to groups such as real estate professionals homeowner associations and senior centers that are interested in learning more about the services at the tax office The tax office regularly conducts property tax and motor conveyance seminars with group organizations at locations such as Lou Walker Senior Center Central DeKalb Senior Center East DeKalb Senior Center Belvedere Civic Club Toney Valley Civic Association and Wounded Warrior Project Each year following the approval of the county s tax digest by the Georgia Department of Revenue tax bills are mailed to homeowners Related stories Fulton County hosting live and virtual town hall meetings on property tax assessments DeKalb County online tax info website will be unavailable until Aug Property tax bills are computed based on millage rates set by the governing agents the fair sphere values determined by the Property Appraisal Assessment Department and the assessment valuation of percent the release mentioned The bills also reflect any credits that may conclusion from EHOST and homestead exemptions DeKalb homeowners will see an increase in their tax bills mostly because of the school tax millage rate Although the DeKalb County School District rolled back its millage rate in its proposed fiscal year budget it will not be enough to offset increases in property values During a series of hearings related to adopting a millage rate of mills a tenth of a mill lower than last year DeKalb County School functionaries noted that in order to have a revenue-neutral impact on taxpayers the rollback would need to be mills The rollback would have offset rising taxes generated by increases in property values Organizations that want to hold a tax bill seminar may contact the tax commissioner s office by completing an online request form For more information about the DeKalb County Tax Commissioner s Office visit DeKalbTax org or call - - for assistance The post DeKalb County Tax Office provides materials to understand property tax bills appeared first on Rough Draft Atlanta